Popular Science: Who decides on the economy? The role of the state and multinational organizations in the automotive industry in Slovakia

States nowadays lure foreign investments by multinational companies. States expect the creation of new employment opportunities as well as economic growth and development. The automotive industry in Central Europe and the state approach in the last two decades is a unique example of this. Just like other states in Central Europe, Slovakia belongs to the group of periphery states, but integrated with Western Europe, the core of the European automotive industry. The proximity of large markets and cheap labour are the advantages of these states for multinational companies.

The role of the state and its ability to attract investments from multinational companies are important in the economic integration of the periphery to the core. The states of Central and Eastern Europe are aggressive players in this competition, offering the most favourable conditions for investments by multinational companies. Slovakia started playing this game in 1998, when the new government´s open attitude to foreign investors and its program for the development of the automotive industry was created. Slovakia started to attract foreign investors aggressively with the goal of strengthening the industry. The program was very attractive for investors and also contained educational and infrastructure goals. The results for the period from 1993 to 2013 are astonishing: an increase of produced cars from 3000 to 980 000 per year, Slovakia is the largest producer of passenger cars per capita in the world and 19th in the number of passenger cars. Exports regarding the automotive industry make up 26% of Slovakia’s total exports. The access to the European Union in 2004 accelerated this growth. Most of the factories are owned by foreign companies. Slovakia attracted them through low taxes, cheap labour and generous investment incentives.

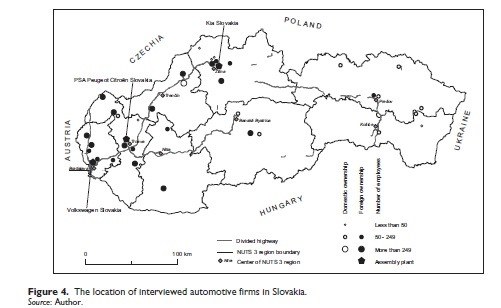

Professor Pavlínek’s key question in the article is what chance does the state’s industrial policy and its economic development based on foreign capital have to enhance its economic position and move to the level of developed countries. The positive effect of foreign capital in the short term is obvious, though with the approach of the global value chain or global production network the situation is not so positive. In the company´s hierarchy these plants are often just assemblers, lower level factories with low added value. There is little chance for moving up in the company´s hierarchy or for research and development. Most of the components for assembly are imported from abroad. The assemblers have higher vulnerability in economic crises in terms of closing or moving to another country. The concentration of foreign investments in Western Slovakia, where 74% of the companies are located, contributes to unequal economic development.

The Article analyses the role of the state in the successful process of attracting three large assembly firms: Germany’s Volkswagen, France’s PSA and KIA from South Korea. The author shows how the state increased incentives to foreign investors. In the case of KIA it went up to 86 000 dollars for the creation of each job. KIA dictated the conditions of its investment in Slovakia, near the city of Žilina. KIA’s investment is an example of all the advantages flowing just to the investor and nothing to the state, taxpayers or Slovak firms. It shows the state’s weak positon in negotiations with large foreign investors.

Interviews with managers of foreign and Slovak firms show that, in spite of how accommodating the state is towards foreign companies, the government’s attitude towards the automotive industry was assessed negatively by more than half of managers and by 75% of the Slovak firms. It is not surprising because most of the state’s investment incentives flow towards big foreign companies. The basic problem emphasised by managers is the lack of qualified technically-educated specialists in Slovakia, while the Slovak firms are used to working with accessible workers.

The automotive industry in Slovakia employs 60,000 people directly and 140,000 indirectly (Slovakia has 5,410,000 inhabitants), though the unemployment rate is still higher (12%, 2015) than the OECD country average. In the relationship between multinational companies and the state, the firms have the better position. In interviews the managers explicitly said that any government minister is “as far away as the nearest phone”. So firms can dictate conditions and have a huge influence on industrial policy, therefore companies can boost their own interests. However, these interests do not necessarily have to represent the best long-term interests of the society as a whole. The state provided incentives for foreign companies and did not have money for education or science and research, the basic preconditions for successful economic development.

Slovakia is one of the states in Central and Eastern Europe with cheap labour that became assemblers for multinational firms. A similar situation also exists in Czechia, Poland, Hungary and Romania. A constraint for getting out from this short-sighted low-cost strategy is a lack of quality that could help companies rise in the hierarchy of multinational companies. On the other hand companies like KIA, PSA and Volkswagen have very successful strategies, which increase their income and competitiveness through the transfer of production to suitable countries. For example, the hourly compensation in Volkswagen in Slovakia is still 79.4% lower than in Germany. From this point of view, the development of the automotive industry in Slovakia and also in the rest of Central Europe depends on the success of the multinational companies more than the success of these countries, as it is often presented. Multinational companies have successfully transferred their technology, organization and form of production. The future of the automotive industry in Slovakia and in Central Europe will still depend on the transfer of technology, know-how and capital from developed countries. Developments in the automotive industry have increased Slovakia’s dependence on foreign capital, which will protect its own interests. Over the long term the investments by large firms will be exceeded by the income in dividends and the value produced in Slovakia will flow abroad. In the Czech Republic we also see the transfer of value and income from Central Europe. It makes it difficult to catch up to developed countries economically. Instead the countries will stay in an unequal economic position within the European and world economy.

Tomáš JANÍK

Document Actions